SDV Market

The automotive industry is at the forefront of a technological revolution, transitioning from hardware-driven mechanisms to Software Defined Vehicles (SDVs). In SDVs, software defines the vehicle’s core functions, offering unparalleled adaptability, efficiency, and user experience. This shift is not just an evolution but a disruption, reshaping the global competitive landscape and creating a matrix of partnerships between automakers, tech firms, and suppliers.

Market Growth: The Billion-Dollar Opportunity

The SDV market is on a rapid growth trajectory, with projections revealing its immense potential:

- Current Market Size: Estimated at $49.3 billion in 2024, with expectations to soar to $449.5 billion by 2034 at a compound annual growth rate (CAGR) of 25.2%.

Key Players and Strategic Initiatives

Tesla: The Pioneer

- Centralized Computing: Tesla has replaced traditional distributed ECUs with a centralized architecture, facilitating over-the-air (OTA) updates and rapid software iterations.

- In-House Expertise: By managing software development internally, Tesla ensures seamless integration and customization of features.

Volkswagen Group: Collaborative Vision

- Rivian Joint Venture: Volkswagen invested $5 billion in 2024 to co-develop electric vehicle architectures with Rivian. This partnership supports SDV advancements across Audi, Porsche, and other Volkswagen brands. (Source: The Atlantic)

General Motors (GM): Platform-Driven Innovation

- Ultifi Architecture: GM’s software platform powers OTA updates, cloud services, and feature personalization, enabling consumers to experience unprecedented flexibility. (Source: Forbes)

Mercedes-Benz: Proprietary Excellence

- MB.OS Development: Mercedes focuses on in-house software solutions to support infotainment and autonomous driving technologies.

- Collaborative Foundations: In 2024, Mercedes joined other German automakers and suppliers like Bosch and Continental to create a unified software foundation. (Source: Welt.de)

Technological Collaborations: Enablers of Innovation

- NVIDIA and Arm Collaboration

- Details: At CES 2025, NVIDIA and Arm announced a collaboration to advance processing and connectivity in SDVs.

- Purpose: The partnership aims to enhance the performance of SDVs, particularly in the integration of Generative AI applications. Computer Weekly

- Honda and AWS Partnership

- Details: Honda and Amazon Web Services (AWS) have entered into a strategic collaboration to uplift the automotive sector with software-defined vehicles that use cloud computing, generative AI, and IoT technologies to enhance EV capabilities.

- Purpose: This partnership aims to revolutionize the future of mobility by integrating advanced cloud services into vehicle software platforms. Home of Technology News

- Tata Technologies and Telechips Collaboration

- Details: Tata Technologies and Telechips jointly announced their strategic partnership at CES 2025 to innovate vehicle software solutions for next-gen software-defined vehicles (SDVs).

- Purpose: Together, they aim to develop innovative solutions for Advanced Driver Assistance Systems (ADAS) platforms. Tata Technologies

- Siemens and Infineon Collaboration

- Details: Siemens is integrating its embedded automotive software with Infineon’s AURIX TC4x microcontrollers to enable advanced features in software-defined vehicles.

- Purpose: This collaboration supports OEMs in achieving production readiness for next-generation SDV capabilities.

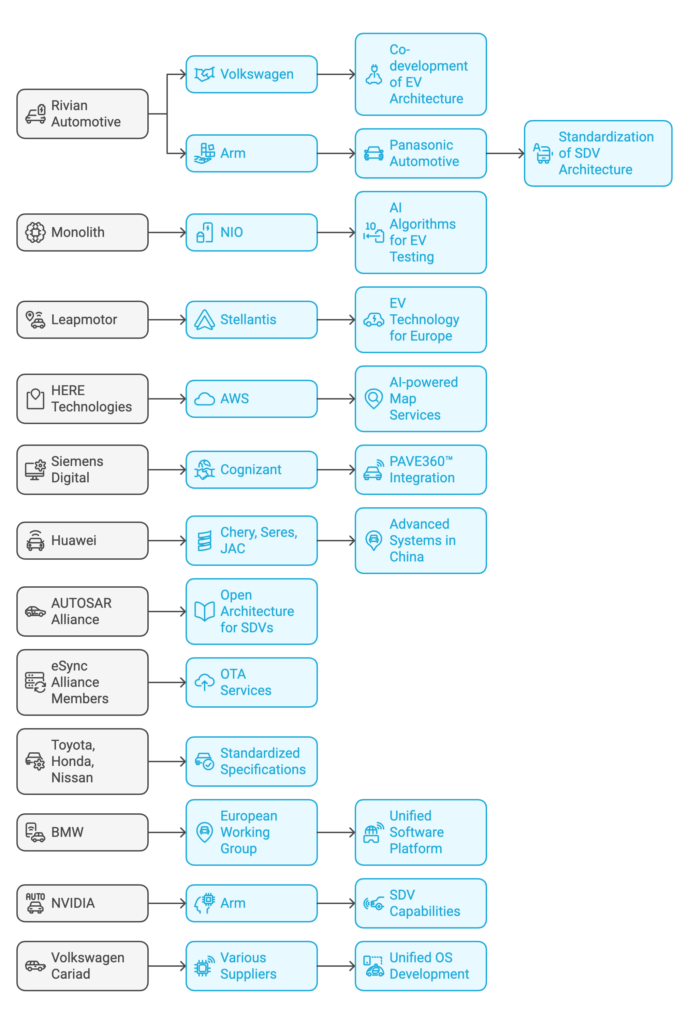

Comprehensive “Who-Supplies-Whom” Matrix for Software-Defined Vehicles (SDVs)

The participating companies / OEMs / software companies are highlighted in the table below:

| Supplier/Partner | Collaborating Company | Product/Service Provided | Region |

|---|---|---|---|

| Rivian Automotive | Volkswagen | Co-development of electric vehicle architecture and software platforms | Global |

| Arm | Panasonic Automotive | Standardization of automotive architecture for SDVs | Japan |

| Monolith | NIO | AI algorithms for real-time EV battery testing and optimization | UK/China |

| Leapmotor | Stellantis | Electric vehicle technology and expertise for European market | China/Europe |

| HERE Technologies | AWS | AI-powered, live streaming map and location services | Europe |

| Siemens Digital | Cognizant | Integration of PAVE360™ into SDV solution accelerator | Europe/Global |

| Huawei | Chery, Seres, JAC | Advanced driver-assistance systems, infotainment systems, and telecoms gear | China |

| AUTOSAR Alliance | Various OEMs & Suppliers | Open software architecture for SDVs, standardizing compatibility across vehicle platforms | Europe/Global |

| eSync Alliance Members | Alpine, Excelfore, Hella | Secure, multi-vendor platform for OTA updates and data services for connected cars | Global |

| Toyota, Honda, Nissan | Collaboration among OEMs | Developing standardized specifications for basic car functions, including wipers and windows | Japan |

| BMW | European Working Group | Collaboration with 50 partners, including Mercedes-Benz, Bosch, and Continental, to create a unified software platform for SDVs | Europe |

| NVIDIA | Arm | Enhancing SDV processing and connectivity capabilities, particularly for Generative AI applications | Global |

| Volkswagen Cariad | Various Suppliers | Developing a unified vehicle operating system across brands like Audi and Porsche, integrating autonomous driving software | Europe |

| BYD | NVIDIA | Integration of NVIDIA’s Orin processors to enhance autonomous driving systems | China |

| Bosch | Daimler | Collaboration to integrate cloud-based autonomous driving features | Europe |

| Waymo | Volvo Group | Development of autonomous trucks powered by Waymo’s driver technology | US/Europe |

| Hyundai | Aptiv | Joint venture (Motional) focused on developing autonomous vehicle software and systems | South Korea/US |

| Didi Chuxing | BAIC, FAW | Integration of smart cockpit software and hardware for connected car solutions | China |

Visit our expert podcast on the CrossRoad Times here.

Also read latest trends in the software defined vehicles market.